Click to Skip Ahead

Australia has one of the highest pet ownership rates in the world, with almost 70% of Australian homes keeping a pet. This is largely made up of dogs and cats, but a large percentage of other pets, too. With all these pets comes a ton of food requirements, pushing the Australian pet food market to new highs every year. In 2023 alone, the pet food market in Australia was worth over AUS$3.0 billion!

With the pet industry in Australia growing every year, the pet food industry is an ever-growing market. Let’s look at some of the most notable pet food industry trends and statistics this year.

Top 10 Australian Pet Food Industry Statistics

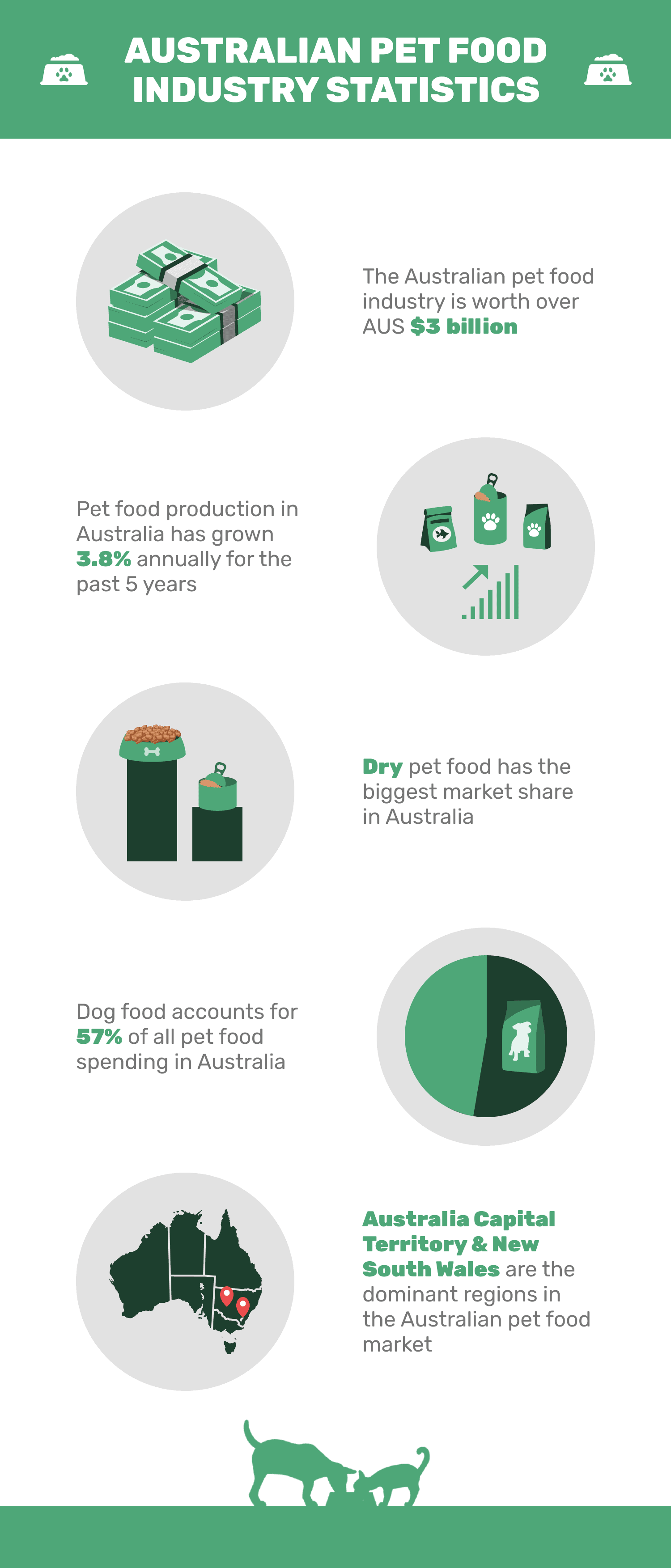

- The Australian pet food industry was worth AUS$3 billion (US$1.9 billion) in 2023.

- Pet food production in Australia has grown 3.8% per year since 2016.

- The Australian pet food market is expected to grow by 2.7% per annum until 2026.

- Premium raw and fresh pet food accounts for 1–3% of the market in Australia.

- The premium raw and fresh pet food market is expected to rise to 10%.

- Dry pet food has the biggest market share in Australia.

- Dog food accounts for 57% of all pet food spent in Australia.

- Australia Capital Territory & New South Wales is the dominant segment in the Australian pet food market.

- Around 69% of Australian households own pets.

- Dogs are the most common pet in Australia.

The Australian Pet Food Industry in Numbers

1. The Australian pet food industry was worth AUS$3 billion (US$1.9 billion) in 2023.

(ibisworld.com)

The pet industry in Australia was worth a staggering AUS$13 billion in 2023, with AUS$3 billion of that revenue generated by pet food alone. This number has declined 2.0% over the past five years.

2. Pet food production in Australia has grown 3.8% per year since 2016.

(ibisworld.com)

While pet food revenue in Australia has declined over the past five years, pet food production overall has increased by 3.8% annually since 2016. This is likely due to Australians having less discretionary income due to the COVID-19 pandemic and consumers switching to cheaper pet foods over raw or private-label foods due to both shortages due to restrictions and for financial reasons.

3. The Australian pet food market is expected to grow by 2.7% per annum until 2026.

(mordorintelligence.com)

Despite the decline over the past five years, the Australian pet food market is expected to grow by 2.7% annually, forecasted until 2026. This is attributed to increasing prices rather than the overall increase in pet populations and the fact that consumers are becoming more educated and concerned over the well-being of their pets, leading them to opt for more expensive, high-quality foods.

Australian Pet Food Segmentation

4. Premium raw and fresh pet food accounts for 1–3% of the market in Australia.

(mla.com.au)

Premium raw and fresh pet food still only accounts for 1–3% of the pet food market in Australia, although this is expected to grow exponentially in the near future. COVID-19 restrictions led to massive delays in deliveries for e-commerce pet food businesses throughout 2020 and 2021, causing many consumers to rely on dry foods and tinned foods over freshly prepared meals.

(mla.com.au)

With more and more consumers shifting from pet “ownership” toward pet “parenting”, it makes sense that the raw and fresh pet food market would be growing in Australia. With COVID restrictions causing fewer delivery delays and more and more pet parents looking for healthier options for their pets, the raw and fresh pet food market is expected to rise to 10% or more of the market going forward.

(globenewswire.com)

Dry pet food holds the biggest pet food market share in Australia and will likely continue to do so far into the future. While many consumers are opting for healthier, fresh-food options for their pets, it’s difficult to beat the convenience and longevity of dry pet foods, and even pet parents who choose fresh foods may still opt for dry foods from time to time. Also, there has been a rise in premium, healthy dry food options in recent years, dominating the market even further.

7. Dog food accounts for 57% of all pet food spent in Australia.

(globenewswire.com)

The biggest market in pet food in Australia is dog food, which makes up 57% of all pet food spend. Dogs are the most popular pets in Australia, with 48% of all households owning a dog, and naturally, dog food would thus have the biggest market share in pet food.

Australian Pet Food Market Size

8. Australia Capital Territory & New South Wales is the dominant segment in the Australian pet food market.

(businesswire.com)

Due to the higher population overall and higher per capita income of people in the region, ACT and NSW are the dominant regions in the Australian pet food market. ACT has the highest average salary in Australia, almost 10% more than the national average. It makes sense, then, that homes with more disposable income would spend more on their pets overall, even though these areas do not necessarily own more pets than the rest of Australia.

9. Around 69% of Australian households own pets.

(kb.rspca.org.au)

There are around 29 million pets in Australia, giving the country one of the highest pet ownership rates in the world. Around 69% of Australian households own pets, the majority of which are dogs and cats, followed by fish, birds, and other small mammals and reptiles. While dogs and cats make up the majority of pets in Australia, birds, fish, and other small pets still account for a sizable portion of the pet food industry, with around 12% of Australian homes owning fish and another 10% owning birds.

10. Dogs are the most common pets in Australia.

(kb.rspca.org.au)

Australia is much the same as the United States in pet choices, and dogs are by far the most common pets, with 48% of Australian homes owning a dog, followed by cats at 33%. Naturally, with dogs being the most common pet in Australia, dog food is the most dominant in the pet food market.

Frequently Asked Questions

How much do Australians spend on their pets?

On average, dog owners in Australia spend AUS$3,218 per animal per year, and cat owners AUS$1,715 per animal per year. In 2022, Australian households spent over AUS$33 billion on pet products and services. Food made up the biggest share of this revenue at 51%, with vet services at 14%. (kb.rspca.org.au)

Is the pet food industry regulated in Australia?

The pet food industry in Australia is essentially self-regulated, meaning there is no official governing body that oversees pet food manufacturing. There are voluntary standards applied through the Pet Food Industry Association of Australia (PFIAA), although this largely leaves the health of your pets in the hands of businesses that are likely more interested in monetary gain than pet health. Although it’s in the best interests of large companies to follow PFIAA standards, companies that don’t voluntarily comply with these standards are still allowed to trade. (frontierpets.com.au)

What are the major pet food companies in Australia?

The Australian pet food market consists of multinational companies as well as private label companies, but the largest players in the market are Mars Inc., Nestle SA (Purina), Colgate Palmolive (Hill’s Pet Nutrition), The Great Australian Pet Food Company, and Australian Pet Treat Company. That said, the rise of fresh and raw meal services is set to skew the market more in favor of smaller businesses in coming years. (mordorintelligence.com)

Conclusion

Despite a small dip over the past five years, Australia’s pet food industry is rapidly growing year by year, with 2.7% growth per annum expected until 2026. This market is largely made up of dog food—as dogs are by far the most popular pet in Australian homes—and dominated by dry food. Australians are beginning to favor fresh, raw, gourmet foods for their pets, though, and this industry is set to grow substantially over the next few years.

Featured Image Credit: marialevkina, Shutterstock