Picking the right pet insurance is tricky. You want to find insurance that will keep your dog or cat safe and help keep vet bills down, but if you get the wrong plan, you might end up paying more over time than you can save. If you’re native to Minnesota, on average, you’ll spend more than $1,300 annually on vet care, making it one of the more expensive states to care for an ailing pet, so getting the perfect plan is even more important1. Here are our favorite companies to help you find the right pet care for you.

A Quick Comparison of the Winners for 2024

| Image | Product | Details | ||

|---|---|---|---|---|

| Best Overall |

|

Spot |

|

Click to Get Quote |

|

Pets Best |

|

Click to Get Quote | |

|

Trupanion |

|

Click to Get Quote | |

|

Embrace |

|

Click to Get Quote | |

|

Figo |

|

Click to Get Quote |

The 15 Best Pet Insurance Providers in Minnesota

1. Spot —Best Overall

Spot offers both accident only coverage or accident and illness coverage. It even covers illnesses that are common in pets like hip dysplasia and cancer. Spot also offers holistic therapy coverage like acupuncture which isn’t very common in the pet industry market. Above all one of our favorite things about Spot is that as long as your pet is older than 8 weeks than you can get coverage.

2. Pets Best

Pets best is one of our favorite pet insurance options because it has great coverage and good customer service at a low price. This company has no lifetime limits and maximum payout options of $5,000 or unlimited. The deductible ranges from $50 to $1,000, which several choices and reimbursement rates are 70%, 80%, or 90%. There are multiple Customer Support options as wrong as e-filing and direct deposit options. However, claim processing is a little bit slower, averaging about 10 to 30 days to process.

3. Trupanion

Trupanion is a little bit more expensive than many companies when it comes to pet insurance, but it does have some perks. These include coverage from birth, a 24/7 customer service team, and a good customer service reputation. Their claims are processed very quickly, averaging only a two-day waiting period. They also have a wide range of deductible options, including a $0 option. Their reimbursements rate is set at 90%, and their payout is unlimited, which contributes to the higher price. They do have some exclusions and don’t cover exam fees or Wellness care.

4. Embrace

Embrace Pet Insurance is a pricier plan, but you do get a lot of coverage for your dollar. This includes behavioral therapies, exam fees, dental illness coverage, and alternative therapies. It even covers curable pre-existing conditions after your pet is one year free from treatment.

Embrace offers a variety of options to help you customize your payment, with reimbursement rates ranging from 70%–90%, five maximum payout options starting at $5,000 and including unlimited payout, and deductible options ranging from $200 to $1,000. This lets you decide how much coverage you need. They also have an excellent reputation for customer service and process claims within five days on average.

5. Figo

Despite its low price, Figo doesn’t skimp on coverage. This company covers most conditions, including curable pre-existing conditions after one year free of treatment. There is an extra fee for exams, and there are a few odd exclusions—for example, if one knee has been previously injured, neither knee will be covered. Reimbursement ranges from 70% to 100% and max payouts are at $5,000, $10,000, and unlimited. Deductibles range from $100 to $750. There is a 5% discount for enrolling multiple pets, and pets can be enrolled at any age. Figo is also known for good customer service and fast processing, with 50% of claims closed in 24 hours and claims averaging only three days.

6. AKC

AKC pet insurance is the insurance company of the American Kennel Club. As such, it offers coverage for mixed breeds and purebred dogs but is most useful for purebred dogs, including breeds that often are not insured. Deductibles range from $100 to $1,000, with 70% to 90% coverage. The annual limit varies, with a limitless payment option available. There are some limits on coverage, with many types of hereditary conditions requiring extra fees for coverage and enrollment before your dog is two. Exam coverage, Wellness coverage, and some other coverage types must be purchased separately.

- Related Read: How Much Does AKC Pet Insurance Cost?

7. Progressive

If Progressive pet insurance has coverage that looks familiar, that’s because Progressive offers pet insurance through Pets Best. That means that its customer service, claims processing, and coverage are all very similar to the standard Pets Best plans. However if you already have Progressive Insurance for something else in your life, it might be worth it to bundle your pet insurance through Progressive as well. Progressive has three basic plans, an Accident Only plan, an Accident and Illness plan, and an Accident, Illness & Wellness plan. We like the support that Progressive insurance through Pets Best gives but there aren’t many benefits to going through them instead of going to pets best directly.

8. Geico

Geico pet insurance comes through Embrace pet insurance, so it doesn’t matter much which company you go through originally. Geico will give you a lot of coverage, but it will be at a higher price. There are a variety of options for reimbursement rates, maximum payout, and deductibles, which will help you control your price.

9. USAA*

USAA pet insurance policies are also administered by Embrace, without much of a difference in their policies. Reimbursement rates are 70%, 80%, or 90%. They offer a maximum annual payout ranging from $5,000 to Unlimited and deductibles as low as $200 and as high as $1,000. Their price varies very much depending on the rates that you choose. They have great customer service and excellent coverage but tend to be a little more expensive.

10. ASPCA

ASPCA is harder to predict costs on, with many different coverage options. This includes accident-only coverage, accident and illness coverage, and an optional plan for wellness coverage. Their deductible is between $100 and $500, and their reimbursement rates are 70%, 80%, or 90%. Their maximum payout varies from $3,000 to $10,000. They do cover many things that other plans don’t, including behavioral therapies, alternative therapies, and exam fees.

11. Hartville

Hartville pet insurance is underwritten by the same company as the ASPCA and has very similar conditions. Like the ASPCA, Hartville has received customer complaints about giving low reimbursements and having poor customer service. It can be cheaper or more expensive depending on the coverage amount that you choose, with reimbursement varying from 70% to 90% , a maximum annual payout of up to $10,000, and a deductible between $100 and $500.

12. Healthy Paws

Healthy Paws has one of the fastest payouts of any pet insurance company. With an average of only two days to pay out they have an excellent reputation for customer service, but they do have restrictions on pets that are enrolled after age six. Deductibles range from 100 to 250 dollars. Reimbursement rates start at 50% and increase by 10% increments to 90%. Because of this, their price varies widely. They do have more limited coverage than some other brands, as they don’t cover many pre-existing conditions, behavioral therapies, alternative therapies, or exam fees. They also don’t have a wellness care plan available. Though we love their fast coverage, these restrictions place it a little lower on our list.

13. Pumpkin

Pumpkin pet insurance is a new player in the insurance game, and because of this, it is hard to know how their customer service and coverage measures up. They offer a 90% coverage rate and several options for deductible and maximum annual payout amounts. Their online customer portal is easy to use, but their customer service team is only available Monday to Friday. They tend to be a little bit pricier than comparable insurance companies.

14. Nationwide

Nationwide Pet Insurance is a lower price than many others, but its limited coverage places it low on our list. Its cutoff age of 10 years is lower than many competitors, and it has some significant exclusions, including all hereditary disorders, congenital anomalies, and curable pre-existing conditions. Behavioral therapies are only covered in some plans. It has a flat $250 deductible and payout amounts of between 50% and 90%. Limits are set per condition but there is no overall payout limit. If you have pets other than cats or dogs, though, you are in luck—Nationwide offers exotic pet coverage. It also averages only four days when processing claims.

15. Bivvy

Bivvy is another newer pet insurance company that has very low prices, but also a lower level of coverage. Their maximum annual coverage varies by state, and in Minnesota, it is only $2,000. They also have a lifetime maximum coverage that’s $25,000. They have an optional Wellness care add-on that covers preventative care. Because this company doesn’t have a long track record and has such a low maximum annual coverage, most owners will find that a different company gives them a better experience.

Buyer’s Guide: Choosing the Best Pet Insurance Provider in Minnesota

Buyer’s Guide: Choosing the Best Pet Insurance Provider in Minnesota

Policy Coverage

Different pet insurers cover different conditions and treatment options, and there isn’t one right answer for what fits your needs. It is important to look at what coverage your dog is likely to use—this depends on age, breed, and other factors—as well as whether the extra coverage will be worth the cost. Be especially careful around preventative care and wellness plans, as often the added monthly expense is more than just paying for routine care out of pocket.

Customer Service & Reputation

Although it’s important to look at a company’s customer service reputation, remember that online reviews may skew towards complaints and that no company will have a spotless reputation. That being said, if you see many reviews pointing out the same issue, the company likely has some shortcomings. Good insurance should make claims and repayment easy and free of hassle, so that you can get the coverage you need without a fight. It’s also important to check if Customer Service is available in your company. Can you reach them by phone, text, or email? Are they open nights and weekends? In an emergency, being able to talk to your insurance’s customer service is important.

Claim Repayment

Most pet insurance companies require you to initially pay the vet bills and then submit a claim to them for repayment. Repayment speed varies widely between companies, with some taking an average of only a few days to process while others need two weeks or more. Claim speeds are always average and some claims might take longer than others, but if you can’t afford to wait several paychecks without repayment, make sure to find a faster company.

Price Of Policy

Policy prices can vary depending on the coverage, deductible, maximum annual payout, and reimbursement rates. This might be as little as $10 a month or lower for accident-only coverage, or as high as a few hundred dollars a month. When comparing plans, consider what options you’re comfortable with and find plans that match your preferred coverage so that you are looking at similar plans when comparing prices.

Plan Customization

Some companies offer more or less customization than others, but most offer at least a few different options. You might see coverage add-ons that are available for an additional fee and change the monthly price of your plan. Many plans also let you customize your deductible and maximum payout to help you find a price that works for you. Some companies offer a fixed reimbursement rate, while others might give you two or three options.

FAQ

FAQ

What are Deductibles, Maximum Payouts, and Reimbursement Rates?

Pet insurance companies use deductibles, maximum annual payouts, and reimbursement rates to set out how much of a vet bill they cover. A deductible is the portion you pay first before insurance gives you any money back. This usually ranges from $100 to $1000, but a few companies are higher or lower. From there, you and the insurance company split the cost according to your reimbursement rate. The reimbursement rate is what the insurance company pays, and 70% to 90% is most common. This split until your insurance company reaches a maximum annual payout, after which you take on the rest of the bill. Maximum annual payouts are usually quite high and will rarely be reached. Some pet insurance companies also have a maximum lifetime payout.

How does my pet’s age affect insurance?

Most insurance companies offer insurance to pets starting at a few months old. Insurance is generally cheaper for younger pets. Although pets can stay in the same insurance plan as they age, many companies don’t allow older pets to start a new plan after they reach a certain age. Some insurance companies also cover fewer conditions in older dogs.

Are Wellness Plans and Other Add-ons Worth It?

Many pet insurance plans include optional add-ons such as a Wellness Plan. These might cover more expensive treatment types or preventative care. When considering an add-on, look at whether your dog is likely to use the plan and how much it would cost to pay out of pocket. For many routine care plans, the added monthly cost is greater than just paying for the care yourself, making the plan less worthwhile.

Which Pet Insurance Provider Is Best For You?

Although there isn’t one perfect company, these reviews can give you a good starting point for finding the best insurance for your situation. We found Figo to be the best overall pet insurance company with great coverage, fast service, and lower-than-average prices. Pets Best was our favorite value option, as its plans often came out much cheaper than similar plans without losing out on coverage. Trupanion was our favorite premium choice—although it’s a little more expensive, this company has excellent coverage that can’t be beat.

Conclusion

With so many insurance companies out there, it’s hard to make the right choice. Even though our reviews couldn’t possibly cover all of them, these fifteen options are a great starting point to look at some of the available pet insurance options in Minnesota.

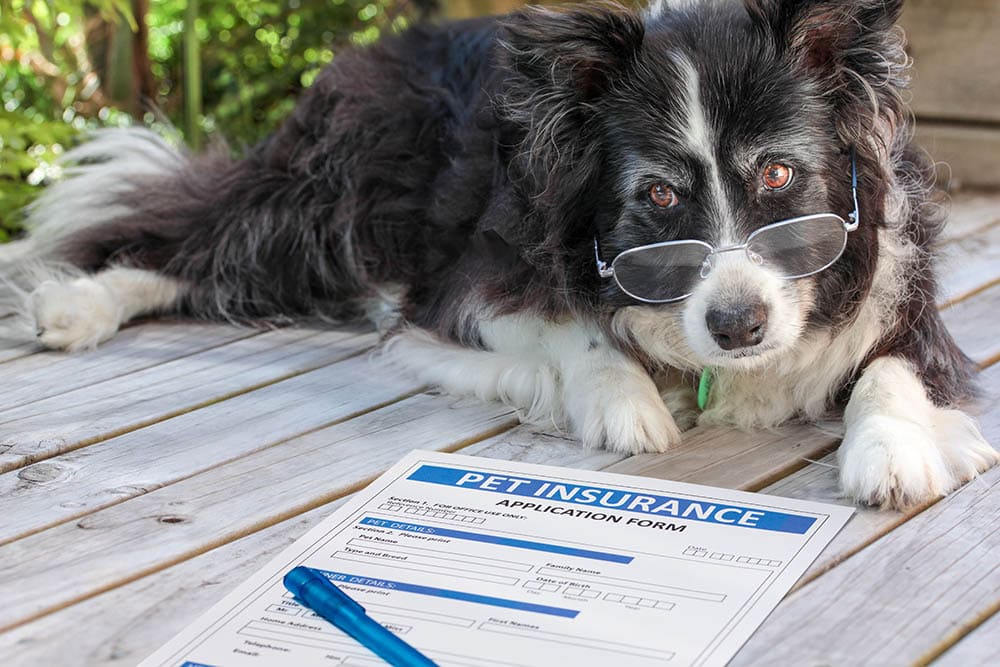

Featured Image Credit: visivastudio, Shutterstock

Buyer’s Guide

Buyer’s Guide FAQ

FAQ