Click to Skip Ahead

Note: This article’s statistics come from third-party sources and do not represent the opinions of this website.

If you’re looking for pet insurance in Canada, you’ve come to the right place! We’ve spent months dissecting the Canadian pet insurance industry to learn what no one else is talking about.

Pet insurance is no longer optional. It has become a must-have product that is essential for any pet owner. Pet insurance ensures your pet gets the medical treatment it needs when it falls ill. Also, it protects against sudden accidents your pet might encounter.

Top 10 Canada Pet Insurance Statistics

Top 10 Canada Pet Insurance Statistics

- The global pet insurance market is expected to surpass $10.2 billion by 2025.

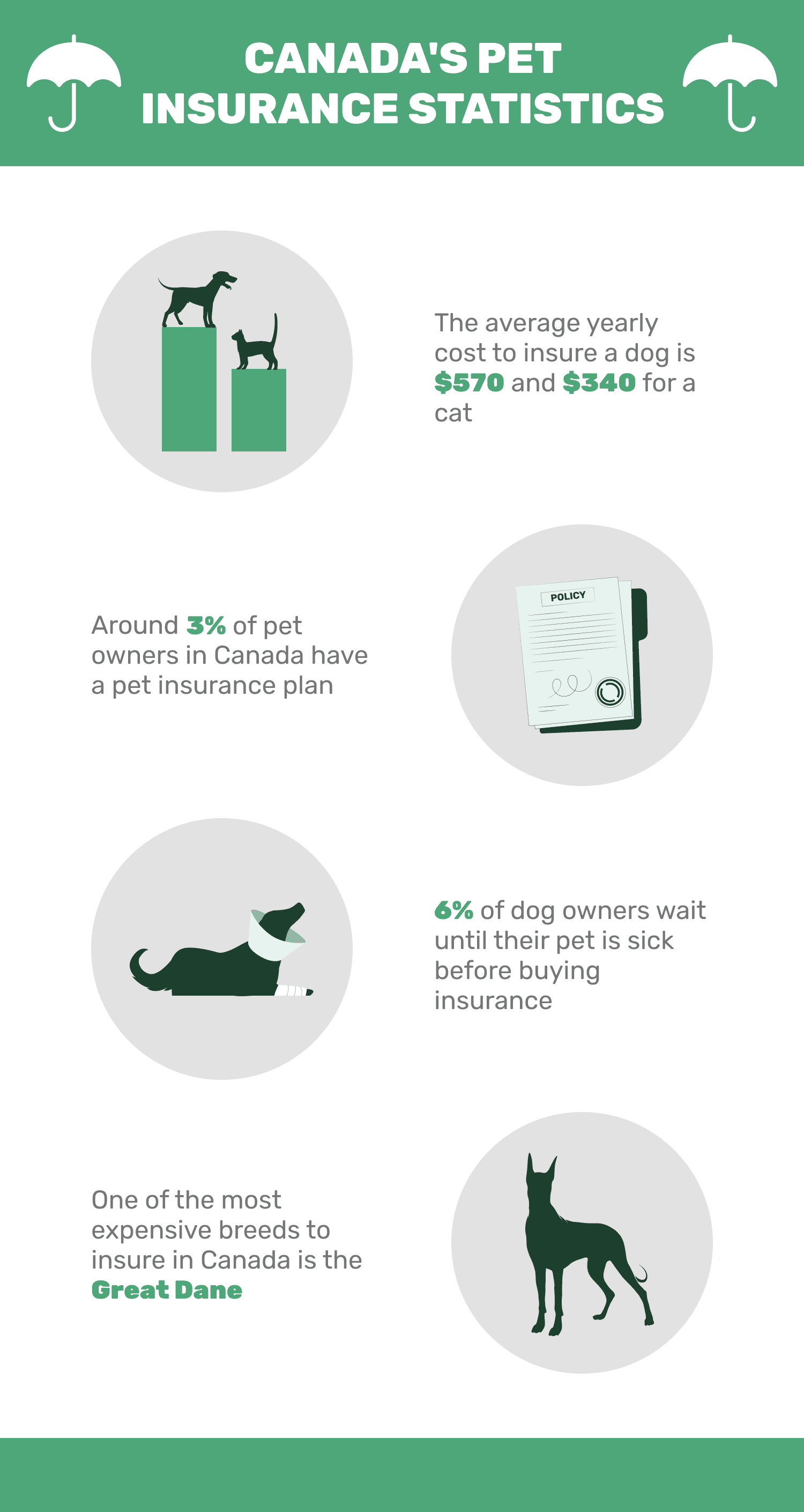

- The average annual cost of dog insurance is $570 and $340 for a cat.

- The maximum yearly limit for many pet insurance firms in Canada is $10,000.

- Around 3% of pet owners in Canada have a pet insurance plan.

- In Canada, pet insurance covers a wider variety of treatments. It’s more expensive than in the US.

- Most insurers in Canada do not allow pet owners to make claims for pre-existing conditions.

- To ensure that your pet insurance claim is paid, it should be filed within two months of any injuries or illnesses your pet has incurred.

- Between 10% and 20% of all cats in Canada die from feline upper respiratory infections. It’s often preventable if you have pet insurance coverage.

- The most expensive breeds to insure in Canada are Dogue de Bordeaux and Great Dane. Others include Greater Swiss Mountain Dog, Bullmastiff, and Newfoundland.

- 6% of dog owners and 2% of cat owners wait until their pets are sick before buying insurance for them.

The Cost of Pet Insurance in Canada

1. The global pet insurance market is expected to surpass $10.2 billion by 2025.

(RESEARCH MARKETS)

According to pet insurance market statistics from Research and Markets, the rise in the adoption of pet insurance is fueled by the increasing instances of pet health issues. Also, it’s caused by growing awareness about the importance of pet healthcare, and an increase in disposable income.

Technological advancements in the veterinary industry have led to advanced pet products. These technological advancements are expected to be one of the primary drivers for the growth of the pet insurance market.

2. The average annual cost of dog insurance is $570 and $340 for cat insurance.

(VALUE PENGUIN)

Although there are more cats than dogs in Canada, a cat’s pet insurance is less expensive than a dog’s. It’s because a cat requires less care. Per year, a dog’s cover can go up to $570, while that of a cat is relatively lower at $340.

However, when shopping for pet insurance, don’t just focus on price. Look at what kind of benefits each plan offers. Also, check out online reviews to see if the company has had any complaints regarding its customer service.

3. The maximum yearly limit for many pet insurance firms in Canada is $10,000.

(TIME)

A good annual limit for pet insurance ensures your pet is fully covered in terms of treatments. The amount depends on your budget and how much you can afford to pay out each year.

The maximum annual policy for most firms is $10,000. These figures can be much higher or lower depending on what you want the policy to cover. Some companies may offer unlimited annual limits, but not all insurance plans and companies are available in all provinces.

If you have a large pet that needs extensive treatment and has an accident once a month, you will spend a lot on vet bills every year. On the other hand, if your pet has an accident only once every couple of years, you can get away with a basic insurance policy and spend less.

The more insurance coverage you have, the more it will cost. But, in most cases, pet insurance costs are reasonable and pocket-friendly.

How Many Pet Owners Have Pet Insurance and What’s Covered in Pet Insurance?

4. Around 3% of pet owners in Canada have an insurance plan.

(PHI DIRECT)

As any pet owner can tell you, pets are not cheap. However, pet insurance is not popular in Canada, and few pet owners have an insurance plan.

This is quite an alarming fact, given that veterinary care is quite expensive. There is a need for pet owners in Canada to be sensitized to see the need for having pet insurance.

5. In Canada, pet insurance covers a wider variety of treatments but it’s more expensive than in the US.

(CONSUMER REPORTS)

There are lots of different pet insurance plans available. Each one offers different coverage for diverse rates. Canadian pet insurance firms are more costly than those in the US.

But treatment coverage can differ from policy to policy. So, you need to understand what your policy will cover before you purchase it. The best way to do this is by looking at a policy and understanding it thoroughly before you buy it.

6. Most insurers in Canada do not allow pet owners to make claims for pre-existing conditions.

(PET ASSURE)

When an insurer pays out benefits for an illness or injury already present when enrolling, it opens a potential for fraud. It’s because owners may hide information about their pet’s symptoms during the application process.

It means that if your pet has been diagnosed with a condition before applying for insurance, no benefits will be paid out. The insurer can deny payment if they find out the animal had a problem before it was insured.

7. To ensure that your pet insurance claim is paid, it should be filed within two months of any injuries or illnesses your pet has incurred.

(PET INSURANCE)

If you have a claim that needs to be filed, do it as quickly as possible, at least within two months after injury or illness.

It will ensure that you are reimbursed for any injury or illness your pet incurred in the allotted time frame. Claims that aren’t filed within the time frame could be denied.

Reason to Get Pet Insurance and the Breeds Covered

8. Between 10% and 20% of all cats in Canada die from feline upper respiratory infections. It’s often preventable if you have pet insurance coverage.

(WAG WALKING)

Cat owners can help prevent some of these infections by providing their cats with vaccinations, grooming, and dental care. Unfortunately, a change in your cat’s environment or exposure to new viruses could result in an infection even if you’re doing everything right.

Luckily, many feline upper respiratory infections are treatable with antibiotics or other medications. But the cost of treatment can be high if you don’t have pet insurance coverage. Pet insurance for cats is available from many pet insurance companies in Canada.

9. The most expensive breeds to insure in Canada are Dogue de Bordeaux and Great Dane. Others include Greater Swiss Mountain Dog, Bullmastiff, and Newfoundland.

(CNBC)

If you own a dog, you know how expensive pet insurance can get. The average premium for medium-sized dogs is $750 per year. But, did you know that the most expensive breeds to insure are often the largest?

Insurance companies consider the breed when calculating premiums. It’s all about risk: certain dog breeds tend to be more aggressive or have a higher incidence of health problems than other dogs. If a dog’s breed is classified as high-risk, it may have higher premiums.

10. 6% of dog owners and 2% of cat owners wait until their pets are sick before buying insurance for them.

(MDPI)

Pet insurance is growing in popularity as an optional add-on to health insurance policies. However, a recent survey by MDPI found out that some pet owners are waiting until their pets get sick before insuring them.

Pet health insurance isn’t for everyone. Usually, the policies require a deductible before coverage kicks in. Also, many insurers don’t offer plans across states and cities, so whether you can find affordable coverage may depend on where you live.

It is advisable to buy a policy for your pet early enough, not when they fall sick or sustain certain injuries.

Frequently Asked Questions on Canadian Pet Insurance

Frequently Asked Questions on Canadian Pet Insurance

Why are pets with insurance healthier than those without?

Pets with insurance are more likely to be up-to-date on vaccines, thus they have a reduced risk of contracting illnesses and diseases. And even if they fall sick, their medical expenses are catered for, and they will receive the best medical care.

Unfortunately, some pet owners without pet insurance may not be able to afford the high cost of a pet’s medical bills and regular vaccinations. As a result, their pets will be prone to regular illnesses, and due to lack of best medical care, they will tend to be unhealthy most of the time.

(INSURANCE INSTITUTE)

What is covered by pet insurance in Canada?

Most pet insurance companies will cover many aspects of your pet’s medical bills. It includes general health problems, reproductive issues, and vaccinations, diagnostic services, spaying and neutering, and deworming.

Pet health insurance plans may also cover regular check-ups with your vet. It means that you can save money on these routine services and ensure your pet stays healthy with regular vet visits and preventive care. However, the policy doesn’t include surgeries or hospitalization unless the veterinarian recommends them.

You can pay for these plans annually. Others are paid monthly or quarterly based on the insurance plan you choose.

(INSURANCE INSTITUTE)

By how much does pet insurance increase each year in Canada?

The cost of pet insurance increases each year by 10 to 20%. There is a lot of variation between different pet insurance companies. Also, there are lots of factors that can change the price of your insurance policy each year.

For example, you can purchase an insurance policy with a deductible in the range of $50. That may increase up to hundreds of dollars in claims if you have a sick animal that needs to see the vet several times.

Generally, your premiums will increase as your pet ages. It doesn’t mean that your pet becomes more expensive over time. But the risk associated with treating a certain illness or condition is greater with older pets.

For instance, there are fewer claims associated with treating kidney stones in a young dog. Still, some companies don’t charge more for older pets. It all depends on what kind of coverage you need and which insurance company you choose.

(III)

What insurance firms offer the best coverage in Canada?

Ever since pet insurance became available in Canada, pet owners have been wondering which companies are the best. Due to the recent cases of pet-related diseases and accidents, many firms in Canada are now providing pet insurance services.

Some of the best pet insurance firms in Canada comprise Petplan Canada, CAA Pet Insurance, Petsecure Canada, Trupanion Canada, and Pets Plus Us.

(YOUNG AND THRIFTY)

What is the oldest pet age owners can enroll for insurance in Canada?

In Canada, there are several pet insurance providers. Each company has its criteria for how old a pet must be to be insured. The oldest pet that can be enrolled for insurance is between 10 and 12 years.

Also, it is crucial to check the terms and conditions with each company because each has its own rules and regulations about premiums, breed restrictions, and coverage limits.

(PET INSURANCE)

What will happen if an insured pet changes pet owners or is given away?

Pet insurance companies have a variety of policies, and each insurance firm’s policy provides different coverage. If an insured pet is given away or rehomed, ensure you ask the new owner to contact the pet insurance company. They will ensure that the pet’s medical records are transferred from one owner to another.

It’s also crucial to ensure that any pre-existing conditions are documented well in your pet’s medical records. This information will determine if the insurer will provide coverage for a specific ailment or illness once the pet is with a new owner.

What is the most common reason pet owners give for declining pet insurance in Canada?

Cost is the primary reason pet owners decline pet insurance. Also, there is a lack of education on the topic. Most pet owners believe their pets will never need medical care. They also feel that they have many other bills already.

Besides, many pet owners feel they can’t afford to pay premiums every year, and they might not need any insurance coverage at all.

But, many pet insurance providers offer help with the cost of pet insurance. They offer a discount for paying for the first year in one lump sum.

(INSURANCE INSTITUTE)

Factors Determining the Cost of Pet Insurance in Canada

You may be skeptical about how much your pet needs. So, it’s always best to be prepared for the worst-case scenario. Make sure your pets are taken care of if anything were to happen to them. The best way to do this is by insuring them.

Several factors determine how much you’ll be paying. The pet’s age is a crucial factor to consider. Older pets have a higher chance of developing health issues. If you’ve recently adopted an older pet and plan on keeping it until it’s older, consider pet insurance now so that you don’t have to worry about unexpected costs in the future.

Also, consider the pet breed. Some breeds have been known to suffer from certain conditions more than others. If you have a pet breed with a history of health problems, you might be looking at higher premiums for your coverage.

Different pet insurance providers may also offer different types of coverage options. Some may even provide coverage for injuries or illnesses not related to your pet.

Again, pets with lower deductibles cost more than those with higher deductibles. It’s because they have a higher risk of requiring medical treatment. Pets with chronic conditions, such as diabetes, are often considered high-risk. They can be charged a high deductible if they are insured.

Pet insurance companies also use your location to determine the amount to pay for the insurance cover. Pets in urban areas are more expensive to insure because they are more prone to certain chronic illnesses such as diabetes and kidney disease, which can cost thousands of dollars each year to treat. Therefore, if you live in an urban center, you’re going to have a much different experience than someone living in a rural area.

Conclusion

Conclusion

Canada is an increasingly pet-friendly country. It will most likely continue to see an increase in the number of people who own pets. As Canadians start to understand the cost associated with owning a pet, they will become more inclined to buy a pet insurance policy.

Pet insurance policies are still new and foreign to many Canadians. But as they become more sensitized on the subject, we are looking at an increase in the number of pet insurance owners.

Featured Image Credit: stanarchy93, Pixabay

Top 10 Canada Pet Insurance Statistics

Top 10 Canada Pet Insurance Statistics Frequently Asked Questions on Canadian Pet Insurance

Frequently Asked Questions on Canadian Pet Insurance